Death, divorce and disease........

Life’s inevitable tragedies can have unforeseen flow-on effects for small businesses.

Karina Barrymore (heraldsun.com.au Saturday, November 28, 2015)

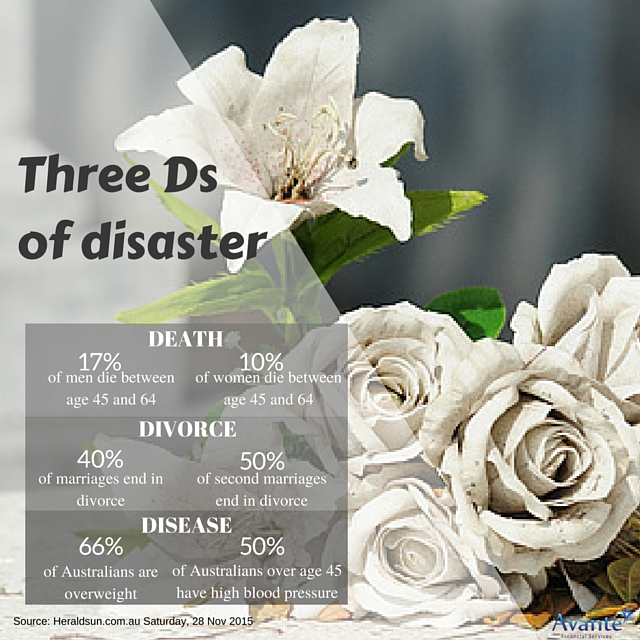

Death, divorce and disease are the biggest threats to Australia’s small and medium-sized businesses with more than half having to shut or sell at fire-sale prices because of one of the “three Ds”. And with two out of three private sector workers employed by small or medium-sized businesses, it also makes the three Ds a major risk to employment and household finances.

According to advisory group Business Exit Companion, about 55 per cent of SME closures or sales are forced on owners because of death, divorce or disease. “Unfortunately, any one of the dreaded three Ds can happen at any time but often people don’t realise that it just doesn’t affect the partner or co-owner going through it, it also affects the whole business,” Business Exit chief Koos Kruger says.

“When businesses are exposed to these events and risks it means their staff and customers are exposed too. For many businesses, the owners are so entrenched and vital to the daily operations that if they are absent because of illness or stress or distracted with other issues, even for a short period, it can actually cause the business to collapse.”

Mr Kruger says that while co-owners or other key staff can often carry on, “it still means added stress and uncertainty, often cash flow and income problems quickly follow and before long the business is at high risk. This situation not only puts the ongoing business at risk, it also reduces the value of the company if eventually the remaining owner or the owner’s family needs to sell,” he says.

Medical industry business owner John Brain found himself in a similar situation when the wife of one of his business partners became ill. “Suddenly, he was completely caught up taking care of his wife and he withdrew from the business in almost an instant,” Mr Brain says. “Not surprisingly, it wasn’t long before he wanted out and he began to push for us to sell. There were a few of us involved as partners so it was a situation that affected all of us and our families.”

According to the Australian Bureau of Statistics, almost one in six males between the age of 45 and 64 die unexpectedly. As 66 percent of business owners are male and within this range, the odds can’t be ignored. In addition, Mr Kruger says, cardiovascular disease affects one in six people, while one in three people over age 45 – the most common age group for male and female business owners – have high blood pressure and one in five have high cholesterol.

Divorce is also a major issue for companies that can quickly impact co-owners, staff and often results in the forced sale of a business. York Law director and family law specialist Nabil Wahhab says almost 40 percent of marriages in Australia end in divorce. The percentage is even higher for second marriages. There is also anecdotal evidence that divorce rates are even higher for business owners because of the added stress and time spent running their companies.

According to Mr Wahhab, in most cases the business will form part of the divorce settlement, either as an asset that needs to be valued or because part ownership needs to be transferred. “Let’s be clear, family law matters can take a long time, up to three years in many cases, for couples to reach settlement” Mr Wahhab says. “There are many things that can go wrong, upset staff, impact incomes and devalue the business during that sort of time frame and that’s assuming it’s all being done in a rational way and, as we know, often there is not a lot of rationality when it comes to divorce. Or worse, in a minority of cases, if there is a vindictive element it can destroy the value of the business completely. Although divorce can’t necessarily be avoided, the impact on SMEs can be managed”, Mr Wahhab says.

“Business partners can document how the business is going to be run, what the role of each person is, in the event of a disagreement or divorce. The document could include how to resolve any problems that upset the working relationship, the operation of the business and eventually valuing and buying out someone’s share.”

Often, he says, the remaining owners won’t have the money to pay someone out immediately but a divorce document can at least include the agreed time frame and formula for this to be calculated to help smooth the settlement and minimise damage to the business.