De-stress mortgage: “Don’t sail out farther than you can row back.” This Danish saying is sound advice for anyone thinking of borrowing to buy a home, particularly now that interest rates are low and house prices are generally rising.

According to a paper for the Centre of Policy Development and University of Canberra, Australians have a tendency to be over-confident in our ability to repay loans. We also underestimate the likelihood of things potentially going wrong in our lives.

Have you ever heard yourself or someone else say “I’ll be able to repay my loan, provided I keep my job, don’t get sick and I’m not hit with any large unexpected bills”? Chances are you probably have. But things can and often do go wrong.

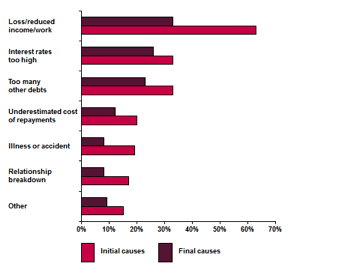

A study was completed for the Royal Melbourne Institute of Technology (RMIT), which looked at the specific triggers that have resulted in Australian households being unable to meet their mortgage repayments. Survey respondents were asked the initial causes and, if they changed, what the final causes were. They were also able to identify more than one cause. The graph below shows the results.

Like most things in life, it’s difficult to make borrowing a stress-free exercise, but there are a few things you can do to reduce the angst.

Most financial institutions determine the maximum loan they will provide based on a multiple of your income and other factors. But if you borrow the maximum amount, you may find you are stretched from day one unless you are very disciplined with your budgeting. A way to de-stress the mortgage is to borrow what you can afford to pay back with ease.

It’s a good idea to hold (or build up) a cash reserve in a mortgage offset account to provide a buffer that can be drawn upon to meet your loan repayments if you become ill or are off work for other reasons.

Many lenders offer insurance when you take out a home loan that covers the mortgage (often up to a specified amount and for a particular period of time) if you die, become disabled or your employment ends involuntarily.

While mortgage protection insurance can provide peace of mind for a limited time frame, other types of insurances should be considered. These include:

Fixing the interest rate on your home loan can provide protection against rising interest rates. The downside is there are often restrictions on making additional payments into a fixed rate loan, which would limit your capacity to build up a buffer. Many people find a combination of fixed and variable rate loans works best, as additional repayments can be made into the variable rate portion of the debt.

Over 40% of the people who completed the RMIT survey responded to the initial difficulty in meeting mortgage repayments by using credit cards more often than they normally would. Using debt to service debt is very likely to compound the problem.

At the first sign of a problem, it’s essential to seek financial advice, as there may be a range of potentially viable options to explore. Better still, you may want to seek financial advice before you decide how much to borrow.

An adviser can help you assess your budget and determine your affordability level. They can help you to focus on other goals you may want to achieve in the short, medium and long term and the cash flow that may be required to meet them. They can also assess your insurance needs and advise you on a range of other financial matters.

To find out more, contact Mohamed Said on <1300 788 650>.